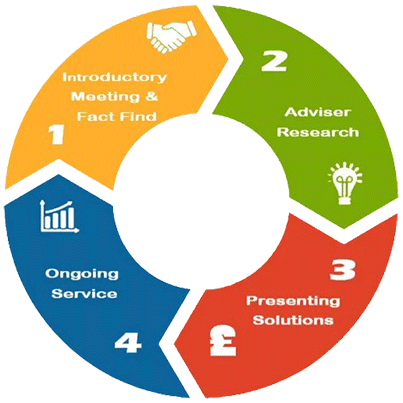

Our Wealth Management Process

In our initial meeting, we'll discuss your current financial situation, budget and discover too, answers to the following questions

What’s important to you and your family?

Where are you at the moment and what are your most urgent priorities?

Where do you want to be and what would you like to achieve in the future?

Who else do we need to consider in creating your plan?

What other issues do we need to consider?

What’s your current investment experience?

Recommendations

Whatever your dreams are in life, good financial advice can help you achieve them. We're here to help you decide what to do right now, so you can live for today knowing you're prepared for the future.

Wealth Creation

Wealth Protection

Retirement Planning

Loans & Mortgages

Insurance

Investments

1. Introductory Meeting & Fact Find

Before any investment strategies can be recommended, we seek to fully understand your situation.

We will gather information on your personal and financial circumstances, taking into account your assets & resources.

From there, we will discuss your goals and aspirations as well as your attitude to risk. This will form the foundation for our future analysis and recommendations

2. Advisor Research

We use the latest analytical tools to understand the breakdown of your existing assets and how these are performing against your set objectives.

We believe that a critical part of design is ensuring there is a match between your goals, aspirations, attitude to risk and the eventual asset allocation of your investment plan.

3 Presenting Solutions

Once we have completed our analysis, we will design a recommended strategy based upon the most appropriate investment options.

We will always present our recommendations in a simple and straightforward way, either by email or hard copy, whichever format you prefer.

4. Ongoing Service

As a client of Mat White Financial Services, you will be offered guidance and support.

Service Proposition Schedule

Proposition 1

Proposition 2

Transactional only

Minimum cost

£500

£250

£NIL

Cost based on the total value of your investments

1.00%

0.50%

£NIL

Minimum cost

12 Hours

4 Hours